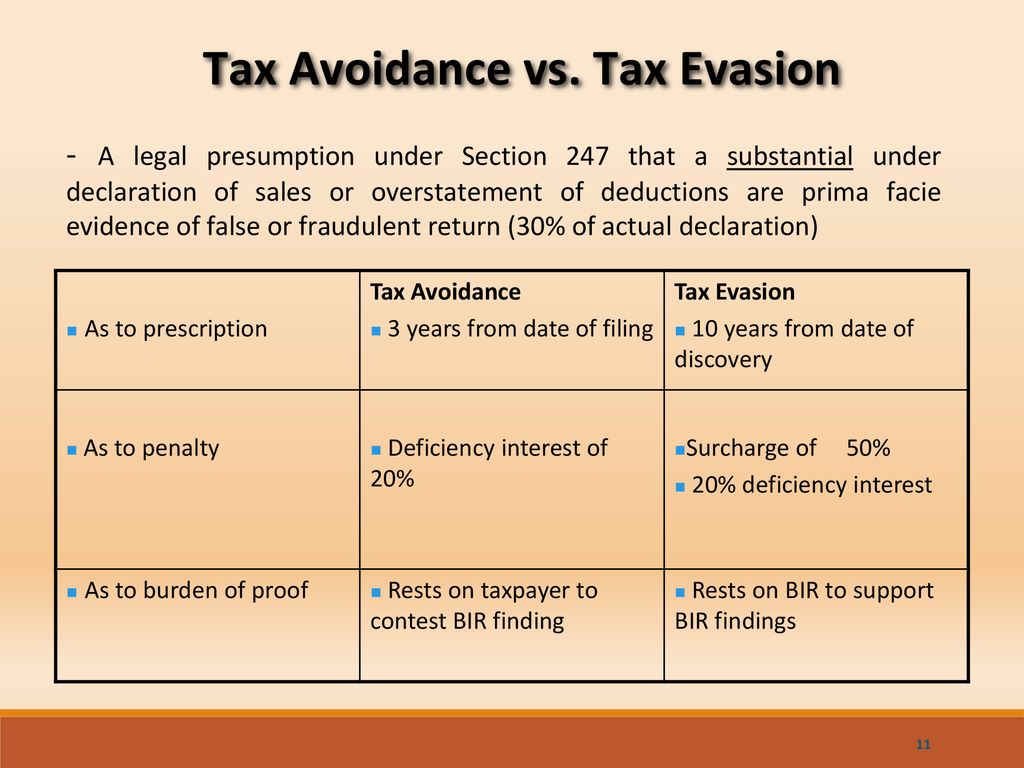

tax avoidance vs tax evasion philippines

A Tobin tax was originally defined as a tax on all spot conversions of one currency into another. This leaves an open question wrt price cap.

Estimating International Tax Evasion By Individuals

229781 october 10 2017 senator leila m.

. Successive administrations have blamed their predecessors for the countrys economic woes but analysts say the malaise stems from decades of poor management and a failure to tackle endemic corruption and widespread tax avoidance. A tax invoice need not be issued for zero-rated supplies exempt supplies and deemed supplies or to a non-GST registered customer. In general a tax invoice should be issued within 30 days from the time of supply.

Your tax invoice must also provide details on exempt zero-rated or other supplies if applicable. A collect the money via the regulator b the political will to implement Germany corporate interests c the political stability Italy Greece etc. Tax shelters are any method of reducing taxable income resulting in a reduction of the payments to tax collecting entities including state and federal governments.

De lima petitioner vs. Tax evasion is an illegal practice where a person organization or corporation intentionally avoids paying his true tax liability. At present there are 31 Philippine Tax Treaties in force.

Price Cap money recovery vs Market Split The data for either is available now via elec marketsregulators. FATCA the Foreign Account Tax Compliance Act was enacted in 2010 to prevent and detect offshore tax evasion by US persons. These publications contain treaties entered into by the Philippines.

Sharifs new coalition government has said it will make the tough decisions needed to turn the economy around. Data and research on tax treaties including OECD Model Tax Convention Mutual Agreement Procedure Statistics prevention of treaty abuse This publication is the tenth edition of the condensed version of the OECD Model Tax Convention on Income and on Capital. Singapore a vibrant island nation hub in Asia has long held the reputation for being able to attract and entice multinational corporations MNCs to come and establish a base on this side of the Asia Pacific region.

The methodology can vary depending on local and international tax laws. Juanita guerrero in her capacity as presiding judge regional trial court of muntinlupa city branch 204 people of the philippines pdir. Tax privileges and exemptions granted under treaties to.

This shorter version contains the articles and commentaries of the Model Tax Convention on. 简体中文 Chinese Simplified MNC Companies in Singapore. 616 en banc gr.

Dela rosa in his capacity as chief of the philippine national police psupt. By the late 1990s the term Tobin tax was being applied to all forms of. The Philippines has entered into several tax treaties for the avoidance of double taxation and prevention of fiscal evasion with respect to income taxes.

Do member states have the capacity to. The payor also must file Form 945 Annual Return of Withheld Federal Income Tax to report any backup withholding. Form 945 must be filed with the IRS by January 31 of the year succeeding the year of payments.

This post is also available in. It was suggested by James Tobin an economist who won the Nobel Memorial Prize in Economic SciencesTobins tax was originally intended to penalize short-term financial round-trip excursions into another currency. Those caught evading taxes are generally subject to criminal.

The Philippines Is A President S Worst Nightmare The Society Of Honor By Joe America

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

Mon Abrea Tax Evasion Vs Tax Avoidance Do You Want To Make Sure You Re Doing The Right Thing Visit Www Sealofhonesty Ph Now Facebook

Concept Of Tax Evasion Tax Avoidance Definition And Differences

What Is The Difference Between Tax Evasion And Tax Avoidance

Philippine Taxation Evasion Or Avoidance Steemit

Tax Avoidance Vs Tax Evasion Infographic Fincor

The Scale Of Tax Evasion By Individuals Eutax

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates

How To Reduce Your Tax Legally And Ethically Ppt Download

Philippine Taxation Evasion Or Avoidance Steemit

Tax Avoidance Costs The U S Nearly 200 Billion Every Year Infographic

Investopedia Video Tax Avoidance Vs Tax Evasion Youtube

Opinion Bongbong S Tax Evasion Karma

Controversies And Case Laws Relating To Tax Avoidance Enterslice